The blog is based on insightful inputs from Maurice Oyare (PesaPoint), Joseck Mudiri (IFC), Edwin Otieno (Software Group), George Muga (Airtel-Africa), Edwin Odira (Telkom), Paul Langlois-Meurinne (Optimetrics), Nic Wasunna (GSMA) and Wilfred Ndirangu (Eclectics)

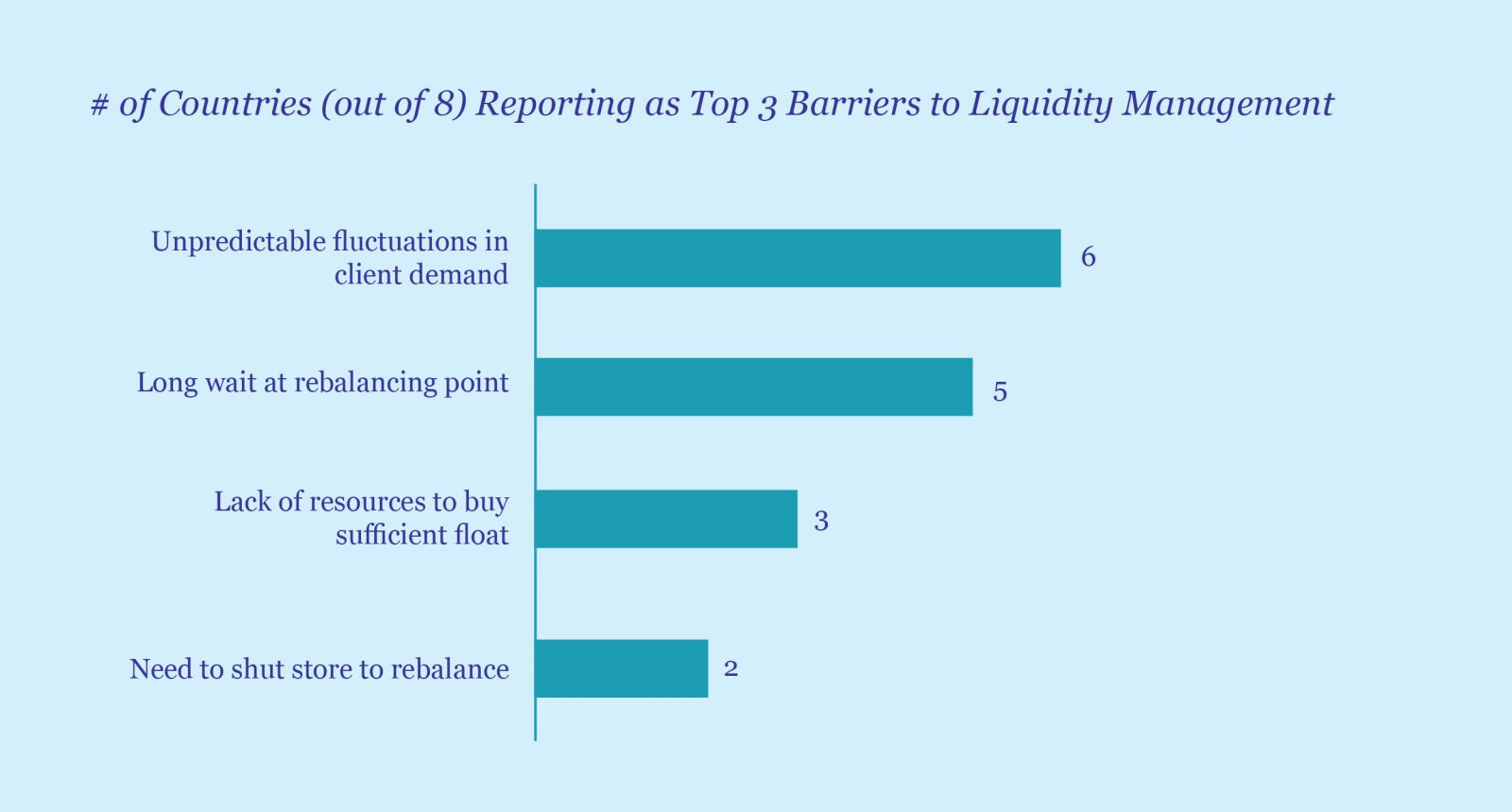

The Helix Institute’s Agent Network Accelerator (ANA) surveys show that agents across the globe cite four key challenges to effective liquidity management. Almost all agents express concerns about their inability to predict and respond to fluctuations in the demand for liquidity. Many wonder how long it takes to get to, and how much time they must wait at, their rebalancing point, which is usually a bank. Agents also worry that they must close their businesses when they have to devote time to rebalance. Furthermore, many agents cite their lack of resources to buy sufficient float to keep their agencies liquid.

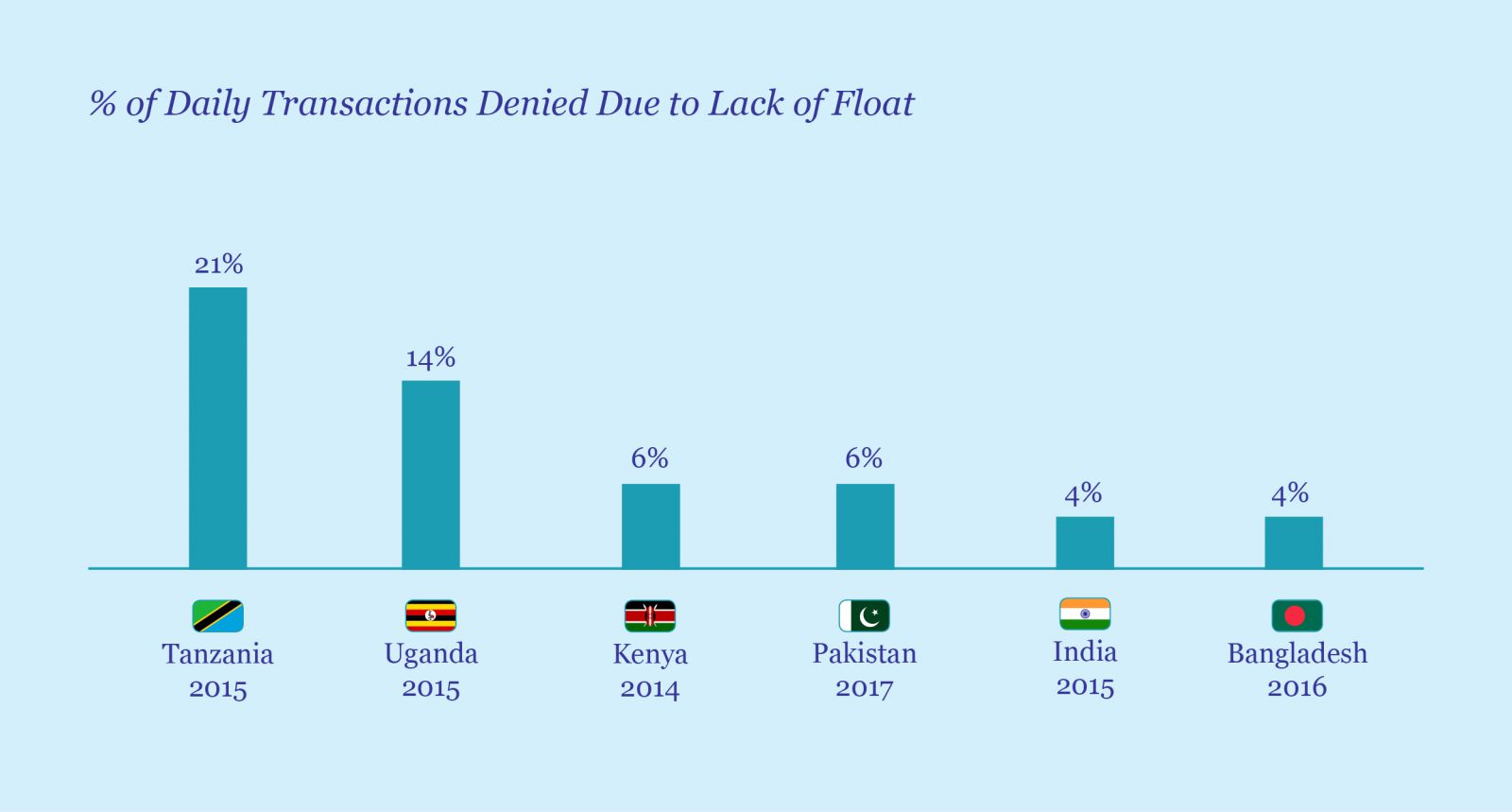

Inefficient cash and e-float management make for unreliable services. As a result, agents find themselves unable to conduct as many as one in five transactions for want of liquidity (see graph below). They are also not able to adopt innovative, if occasionally risky, workarounds.

Illiquid agents negatively impact customer trust in DFS. This, in turn, reduces both uptake and usage of the service – thereby decreasing the return on investment for agents and providers alike. In many cases, the response of agents and providers is to further reduce their investment in the service, thus creating a negative downward spiral. Small wonder that for each among GSMA MMU’s 35 “sprinters” (with more than a million active customers), there are eight deployments that limp along, operating in the sub-scale trap.

Leading players in the DFS industry, including providers, regulators, aggregators, and technology providers, came together in a recent workshop organised by MicroSave’s Helix Institute. They deliberated on innovative ways to address the challenges facing agent networks. The participants divided themselves into three groups to look at key issues in the context of policy and regulation, strategy and market evolution, and operations.

The operations group unanimously identified liquidity management as the primary challenge to agent networks. They began by defining the problems to then devise solutions. The following issues were identified as a result of the exercise.

1. ‘Hands-off’’ Approach to Liquidity Management by Providers

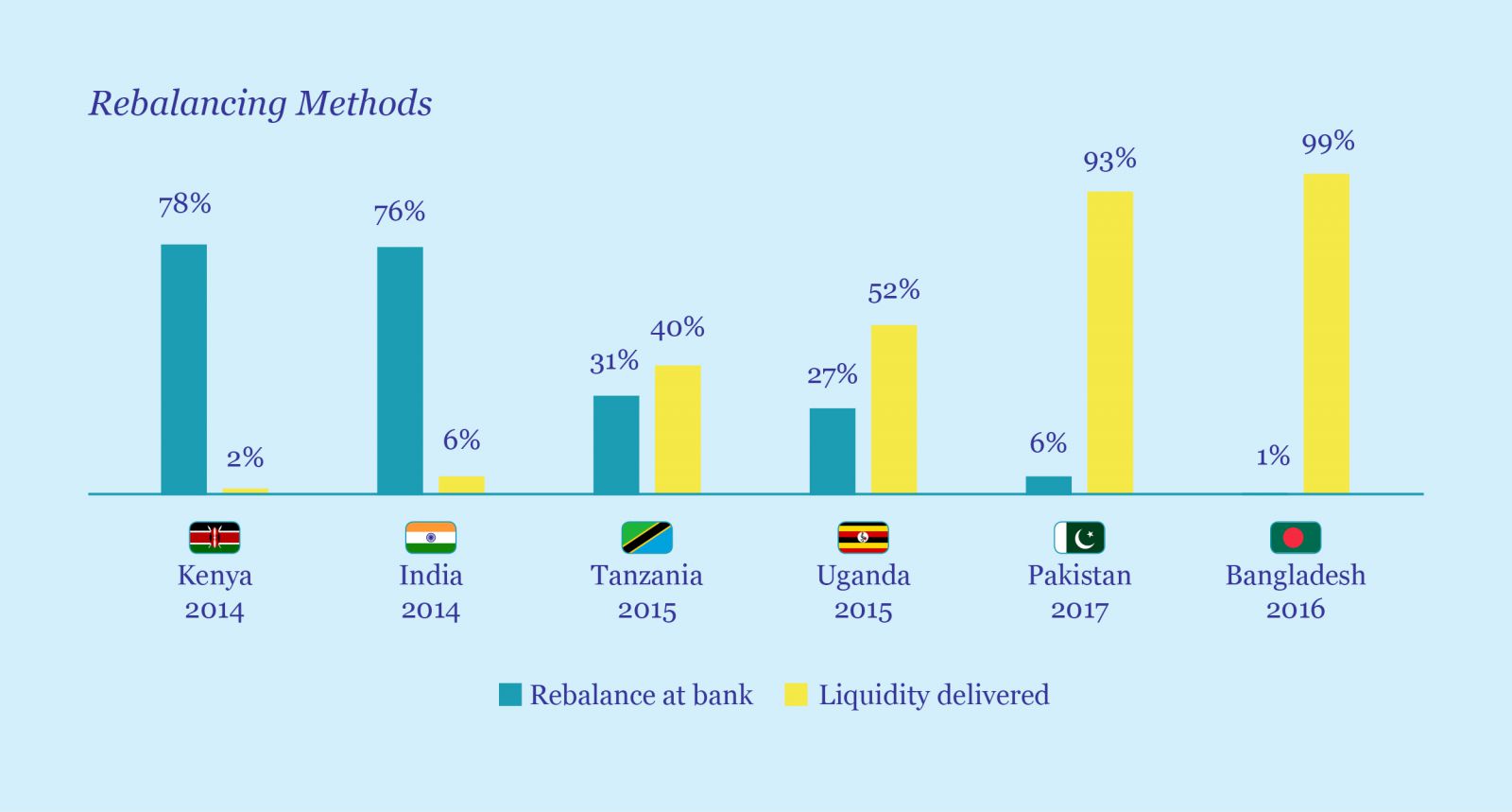

Outside Bangladesh and Pakistan, (where liquidity is usually delivered by ‘runners’ who visit agent outlets to provide e-float or cash), most providers operate on the assumption that liquidity management is the responsibility of the agent.

In the case of better deployments, efforts are being made to establish ‘Super Agents’, such as banks, microfinance institutions, cooperatives and even supermarkets, etc. These Super Agents provide re-balancing points where agents can exchange excess e-float for cash and vice-versa. Many deployments also use a ‘Master Agent’ system to recruit, manage and monitor agents. This often plays an important role in liquidity management, particularly in urban/peri-urban areas in countries like Uganda and Tanzania.

Agents located in rural areas face a specific set of problems. Their far-flung locations imply long distances from providers or Master Agents. They are thus less likely to receive effective or regular support. Moreover, many of the transactions in these areas require ‘cash-out’ of P2P remittances sent from urban areas – so rural agents end up accumulating e-float.

More sophisticated platforms allow providers to track how much e-float an agent holds at a given time. In some cases, the platforms may also provide a portal for Master Agents. These methods allow providers to alert agents and their supervisors when they need to rebalance e-float. However, these systems are unable to track cash balances, which change as the agent sells (and sometimes buys) goods in addition to performing DFS cash-ins and cash-outs.

2. Absence of a Digital Ecosystem

Even in the most developed DFS ecosystems, cash remains king. While providers seek to grow ecosystems through merchants and businesses that accept mobile money payments, interoperability between providers remains rare. The lack of fully interoperable platforms implies that non-exclusive agents who service multiple providers have to maintain separate e-float pools for each. These e-float silos compel agents to spread their working capital for agency across multiple providers, which often reduces the amounts held for each.

Providers need to reconsider existing approaches to agent monitoring and management. Centralised monitoring systems can help identify agents who consistently fail to hold adequate liquidity. Alerts can then be sent to agents whose float levels have dipped below a recommended level to encourage rebalancing.

Novopay in India has a Network Operations Centre (NOC) ‘war room’ with an enormous screen that lets its staff see agent behaviour and transactions at different levels, from country-wide, through individual states, all the way down to individual agents. At the agent-level, Novopay can identify the device being used, track liquidity and even watch the progress of agents through each transaction screen. They can identify if and where the agents make mistakes. Remote-monitoring of tariff display and branding are done by asking agents to submit date-stamped photos of their outlets. Training, alerts and tips are delivered through the agents’ mobile devices. As a result, Novopay has a limited number of in-the-field monitors. Almost all the monitoring is done from their head office in Bangalore over the phone.

These platforms could also facilitate a variety of rebalancing mechanisms. These include rebalancing at ATMs, as well as through inter-agent transfers, where agents can ask for and receive e-float from fellow agents. Agents may also choose to deposit/withdraw money from their personal account into the float account remotely without involving the bank. This is already being done informally on WhatsApp groups set up by Master Agents to manage their agent networks. If providers are able to monitor these activities, they could monitor compliance and define standard operating procedures for their agents.

2. Uber-isation of Agents

Building on the ideas around inter-agent transfers, the group discussed the potential to reduce the dependence on agents by empowering almost every customer to act as cash-in/cash-out (CICO) points. This, of course, is already being done on an informal basis across the globe – particularly in remote areas that are poorly served by agents who are formally supported by providers. Often, local business people or community leaders provide services to convert cash into e-value or vice-versa in an informal manner for a small commission. Using such an approach would mean an increased network of CICO points as well as reduced agency management costs for providers. Customers would benefit from the convenience of proximate services.

In “Reimagining The Last Mile – Agent Networks in India” MicroSave highlighted that “fintech companies can come up with smartphone applications that enable any user to act as liquidity merchants ― mimicking what Uber has done for transportation. Similar initiatives can help address cash needs in the ‘last few hundred yards,’ while agents provide the ‘last-mile’ backup underpinning a more decentralised cash market. To make it work effectively, it needs to be

“Such a smartphone app should implement a geo-referenced marketplace for cash, to supplement an agent network. Users who have need for cash-in or cash-out should be able to search for other willing users in their vicinity. The application should do the match-making on the basis of availability and willingness to connect two ends of the network. The transactions need not be intermediated by the service provider (though the transactions between the two parties should be on the service provider’s system). The app should offer a search capability, as well as a variety of trust-building mechanisms.” – MicroSave.

Along these lines, Eko Financial Services Pvt. Ltd has launched an app called Fundu, which is being geared up for a pilot-test in Kenya. “This app will allow you to act as an ATM… Whenever a Fundu app user near you needs cash, you will get a notification. If you have cash and are willing to provide it, you can accept the request.” The individual will transfer the money to the user’s bank account using his or her virtual address. – LiveMint.

The elegance of this solution is that the users do not need to meet or even know one another. The shortcoming is that there is no scope for the exchange of physical cash. Our discussions with industry stakeholders highlight concerns for the security of agents who currently operate on such ‘Uber-ised’ solutions. Their concerns are that if agents highlight that they have cash at their outlet, it is an invitation for robbery and/or fraud, both of which are growing at an alarming rate.

3. Use of Data Analytics to Predict Demand

Data analytics could be used to monitor transactions and facilitate liquidity management on the basis of historical experiences and trends. This idea is built on a recommendation made by The Helix Institute in 2014 and Harvard Business School in 2017. Using the DFS platform data to identify trends in agents’ demand for e-float or cash will assist in planning for peaks and troughs. This information could be automatically shared with agents and Master Agents by the platform to assist them to maintain adequate levels of liquidity. The analyses would need some modifications to account for unusual ‘outlier’ events that create spikes in demand for liquidity, such as general elections, large sporting events and intermittent bulk payments like remittances to refugees or government subsidy transfers.

Nonetheless, regular SMSs to agents that predict the likely demand for liquidity on a monthly, weekly and daily basis would help them to plan better. It would also inform provider and Master Agent support such as facilitating e-float overdrafts for agents (see below) or organising cash pick-up or drop-off at agent outlets. Providers can also use this data to monitor agent activity, which will help identify unusual or fraudulent practices, such as remote deposit, split transactions and float hoarding.

4. Credit to Allow Agents to Access Working Capital

Agents often cite lack of resources or working capital as key impediments to financing their liquidity requirements. These impediments are sometimes (but not always) temporary, as a result of seasonal fluctuations. While few mobile network operators are willing to take the risk of lending to their agents, extending e-float on credit provides a significant opportunity to improve liquidity and enhance agent loyalty. If lenders use methods like data analytics, they would be able to predict liquidity needs and assess past performance of agents. This should allow lenders to significantly reduce the risk inherent in offering credit to agents.

Furthermore, a system that provides agents with e-float overdrafts to allow them to rebalance using their mobile phones could unlock significant value. It would also reduce the number of transactions declined for want of liquidity. Safaricom, for instance, offers their premium M-PESA agents short-term weekend/public holiday financing to meet their liquidity requirements. This not only boosts the availability of float but also increases the number of agents working over the weekend when banks and other Super Agents are closed. A few banks, such as Commercial Bank of Africa and Kenya Commercial Bank, are already making steps towards this. However, given the sophisticated data analytics and credit platforms required in the process, fintech companies may be best-suited to provide these lines of credit.

5. Set-up Digital Ecosystems

Digital ecosystems consisting of open APIs and fully interoperable platforms would facilitate and encourage the use of digital payments. This can reduce demands to cash out and need for agents to rebalance. Similarly, when FMCG suppliers insist on payment for supplies in e-value rather than cash, it can help rural agents use the e-float they accumulate. High-functioning digital ecosystems can only be achieved if all the players collaborate to increase opportunities for additional digital transactions.

Effective liquidity management is key to any trusted and successful agent network. Yet the much-vaunted challenges are all manageable, particularly if providers leverage data analytics and the capabilities of fintechs.